War, War, and more War... It's good business.

“Listen to me, …: the Lord is with you when you are with Him. And if you seek Him, He will let you find Him; but if you abandon Him, He will abandon you.” ….”For the eyes of the Lord roam throughout the earth, so that He may strongly support those whose heart is completely His. You have acted foolishly in this. Indeed, from now on you will have wars.” 2 Chronicles 15:2(b), and 16:9

And Jesus answered and said to them, “See to it that no one misleads you. For many will come in My name, saying, ‘I am the messiah,’ and they will mislead many people. And you will be hearing of wars and rumors of wars. See that you are not alarmed, for those things must take place, but that is not yet the end.” Matthew 24:4-6

News headline… “Under Pressure, Biden Allows Ukraine to Use U.S. Weapons to Strike Inside Russia”, NY Times, 5/30/24.

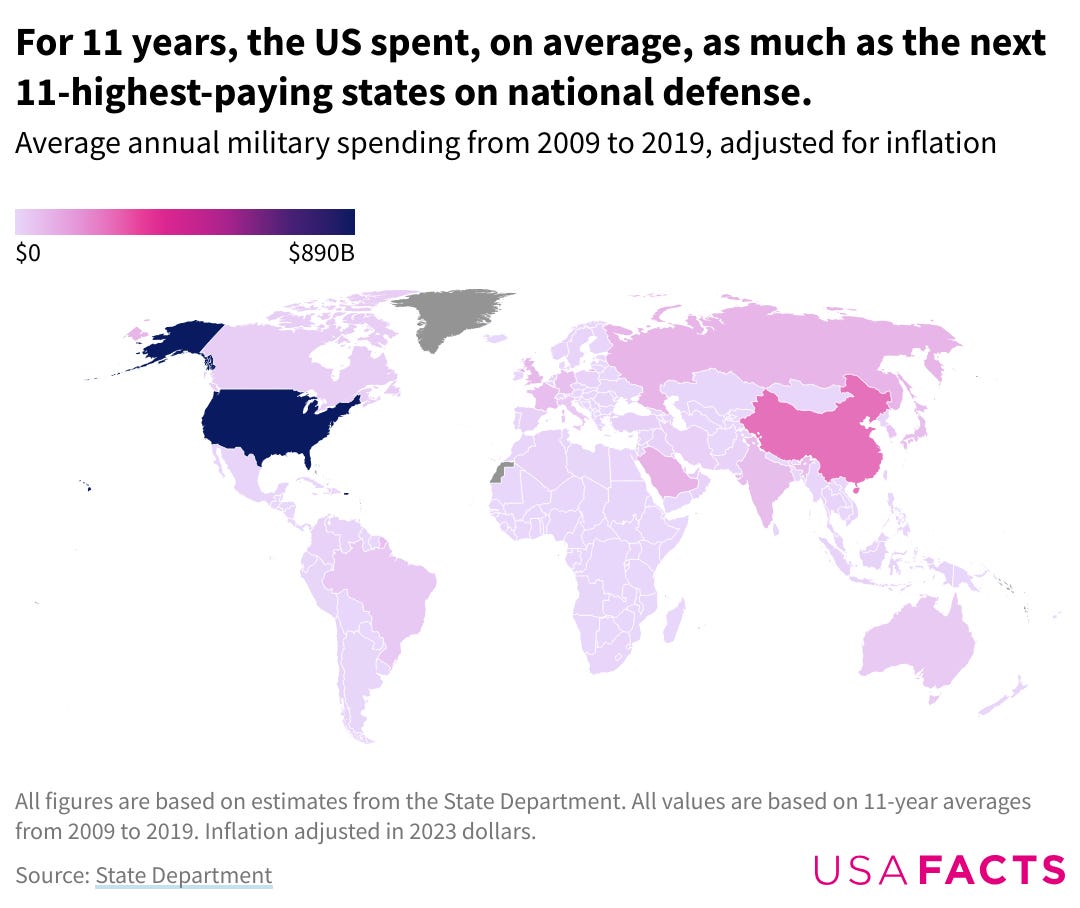

Several thoughts have come to mind as I follow the West’s resolute push by Western elite globalists for war in Ukraine (and in Gaza and who knows where else they are planning it): a few thoughts explain their wanton and evil business solidarity which rests on a number of ideas that seem obvious to an observer:

a. War is not only good for business, war has become a main segment of U.S. business enterprise;

b. Today’s war business system is no longer fueled by a past American ideology now withered during my generation’s coming of age in the Sixties. Before, the shared American ideology was accurately defined by commitment to “individual liberties,” “rule of law,” and “democratic republicanism.” Since then and the anti-God take over of the White House and U.S. government agencies by the neocons and market fundamentalism, their implementation of the 9/11 false flag jump-started 21st century U.S. war business. By neocon Bush Junior’s idiotic rationale for the new era (viz. error) of U.S. war business in the combat of global terror, that is - “they hate us for our freedoms,” today’s U.S. war business has evolved to become a lucrative segment of the global market. Check out Blackrock’s iShares U.S. Aerospace and Defense ETF fund - https://www.blackrock.com/us/individual/products/239502/ishares-us-aerospace-defense-etf. Investors today can expect a hefty 15% plus return. And if you have the stomach and the time, this explanation of the 2024 Dept. of Defense budget. Here’s a piece on Blackrock’s globally-financial dominance.

c. U.S. war business is augmented by highly refined technological sophistication. Blackrock’s iShare uses highly sophisticated algorithms.

Question to ChatGPT - ‘What algorithms does Blackrock use for defense related investment decisions?’

ChatGPT -

“BlackRock, being one of the world's largest asset management firms, likely employs a variety of algorithms and quantitative models for investment decisions across all sectors, including defense-related investments. However, the specific algorithms they use are proprietary and not publicly disclosed.

Here are some key types of algorithms and technologies they use:

1. Quantitative Algorithms

Quantitative or "quant" algorithms are used to make trading decisions based on mathematical and statistical models and analyze historical data and identify patterns to predict future market movements. Quantitative strategies can include:

Statistical Arbitrage: Identifying and exploiting price inefficiencies between related financial instruments.

Factor Investing: Using factors like value, momentum, and volatility to select securities that are expected to perform well.

2. Machine Learning and Artificial Intelligence

Machine learning (ML) and artificial intelligence (AI) are increasingly being integrated into financial algorithms to enhance predictive accuracy and adapt to new data. Key applications include:

Natural Language Processing (NLP): Analyzing news articles, social media, and other text sources to gauge market sentiment.

Reinforcement Learning: Algorithms that improve their trading strategies based on feedback from the market.

Predictive Analytics: Forecasting market trends and asset prices using large datasets.

3. Algorithmic Trading

Algorithmic trading involves executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. These can include:

High-Frequency Trading (HFT): Executing a large number of orders at extremely high speeds, often in fractions of a second.

Execution Algorithms: Algorithms designed to minimize market impact, such as VWAP (Volume Weighted Average Price) and TWAP (Time Weighted Average Price).

4. Risk Management Algorithms

These algorithms are used to assess and manage the risk associated with investment portfolios. They can help in:

Portfolio Optimization: Balancing risk and return to find the optimal asset allocation.

Stress Testing: Simulating extreme market conditions to see how portfolios would perform.

5. BlackRock’s Aladdin Platform

BlackRock's Aladdin (Asset, Liability, Debt, and Derivative Investment Network) is a comprehensive risk management system that integrates various algorithms and data analytics tools. Aladdin helps in:

Risk Analytics: Providing insights into portfolio risks and performance.

Order Management: Streamlining the investment process from order generation to execution.

Compliance Monitoring: Ensuring portfolios adhere to regulatory and client-specific guidelines.

6. Sentiment Analysis

Sentiment analysis algorithms use NLP to analyze text data from various sources to gauge market sentiment. This can inform trading strategies and risk management practices by understanding how market participants feel about particular assets or the market as a whole.

d. Today’s U.S. war business has a business strategy. The article below is copied verbatim from “The NeoCons’ Proxy War “Against Ukraine”: Nuclear War is On the Table. The Privatization of Ukraine” by Prof. Michel Chossudovsky at Global Research, 5/30/24 (https://www.globalresearch.ca/the-neocons-proxy-war-against-ukraine-nuclear-war-is-on-the-table-the-privatization-of-ukraine/5823896).

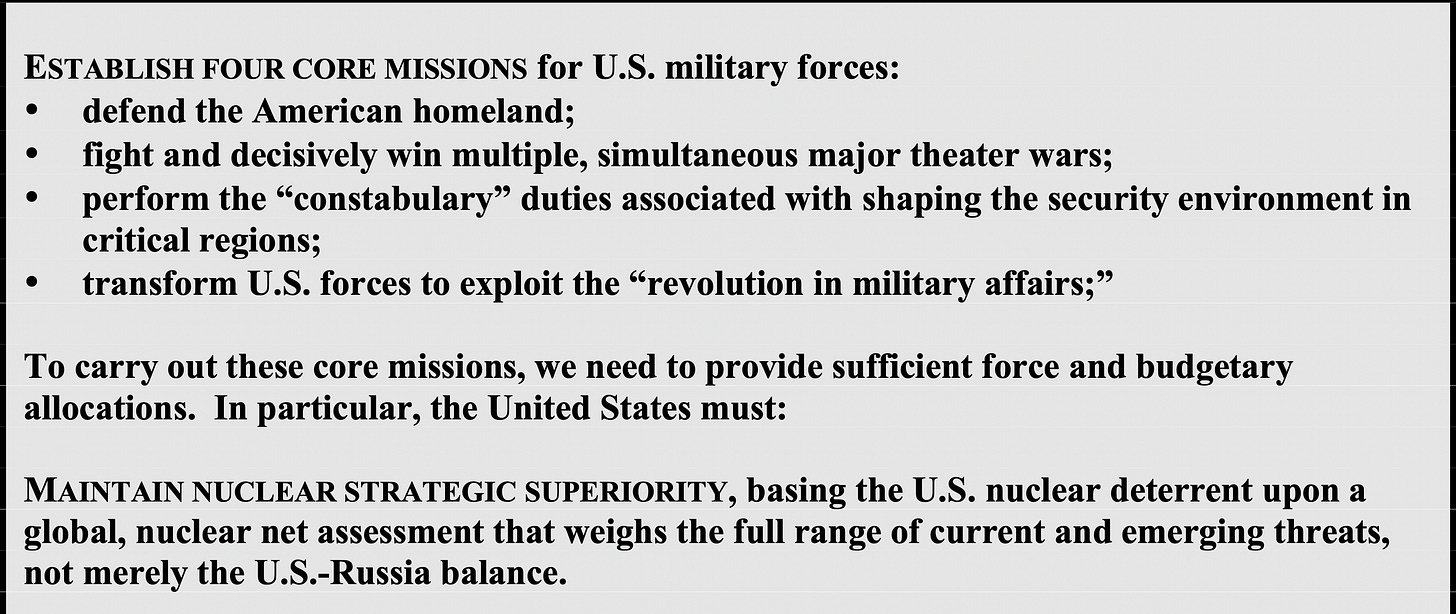

The NeoCon Agenda:

The Project for the New American Century

The NeoCons are firmly behind the Ukraine agenda.

The Project for the New American Century (PNAC) dominates US foreign policy on behalf of powerful financial interests.

The PNAC dispels the planning of “consecutive” military operations: it describes:

America’s “Long War” as follows:

“fight and decisively win multiple, simultaneous major theater wars”

The conduct of “Simultaneous theater Wars” is the backbone of America’s hegemonic Agenda.

It’s a project of global warfare. The PNAC controlled by the NeoCons also dispels the holding of real peace negotiations.

The Nuclear Agenda and Global Warfare

The PNAC was published at the height of the presidential election campaign in September 2000, barely 2 months prior to the November 2001 elections. It has become the backbone of US foreign policy. It is the basis for the carrying out a hegemonic global warfare agenda, coupled with the imposition of a “Unipolar World Order”.

Victoria Nuland who sits in the State Department, currently advising President Biden is the spouse of PNAC’s Robert Kagan.

Why Does the Biden administration require a $1.3 trillion nuclear weapons program which is slated to increase to $2.0 trillion in 2030?

Superiority in Nuclear War is the backbone of the NeoCon agenda as expounded in the PNAC.

The objective is to “Maintain Nuclear Superiority”, specifically in relation to the US-Russia balance.

The Post War Era

The US has conducted numerous wars since the end of what is euphemistically called the post war era:

Korea, Vietnam, Cambodia, Laos, Afghanistan, Yugoslavia, Iraq, Libya, Syria, Yemen… and now Ukraine.

The unspoken objective is not to “win the war” but to engineer the destruction of entire countries, create political and social chaos, with a view to ultimately “picking up the pieces” and taking control of the national economies of sovereign nation states.

This agenda is also conducted through “regime change”, “color revolutions” and the concurrent demise and criminalization of the state apparatus coupled with “strong economic medicine” and the imposition of a soaring dollar denominated debt.

That is what happened in Vietnam. The Destruction of an entire country which was then “privatized” in the early 1990s:

“Vietnam never received war reparations payments from the U.S. for the massive loss of life and destruction, yet an agreement reached in Paris in 1993 required Hanoi to recognize the debts of the defunct Saigon regime of General Thieu. This agreement is in many regards tantamount to obliging Vietnam to compensate Washington for the costs of war.”

And now what is ongoing in Ukraine is the outright privatization of an entire country.

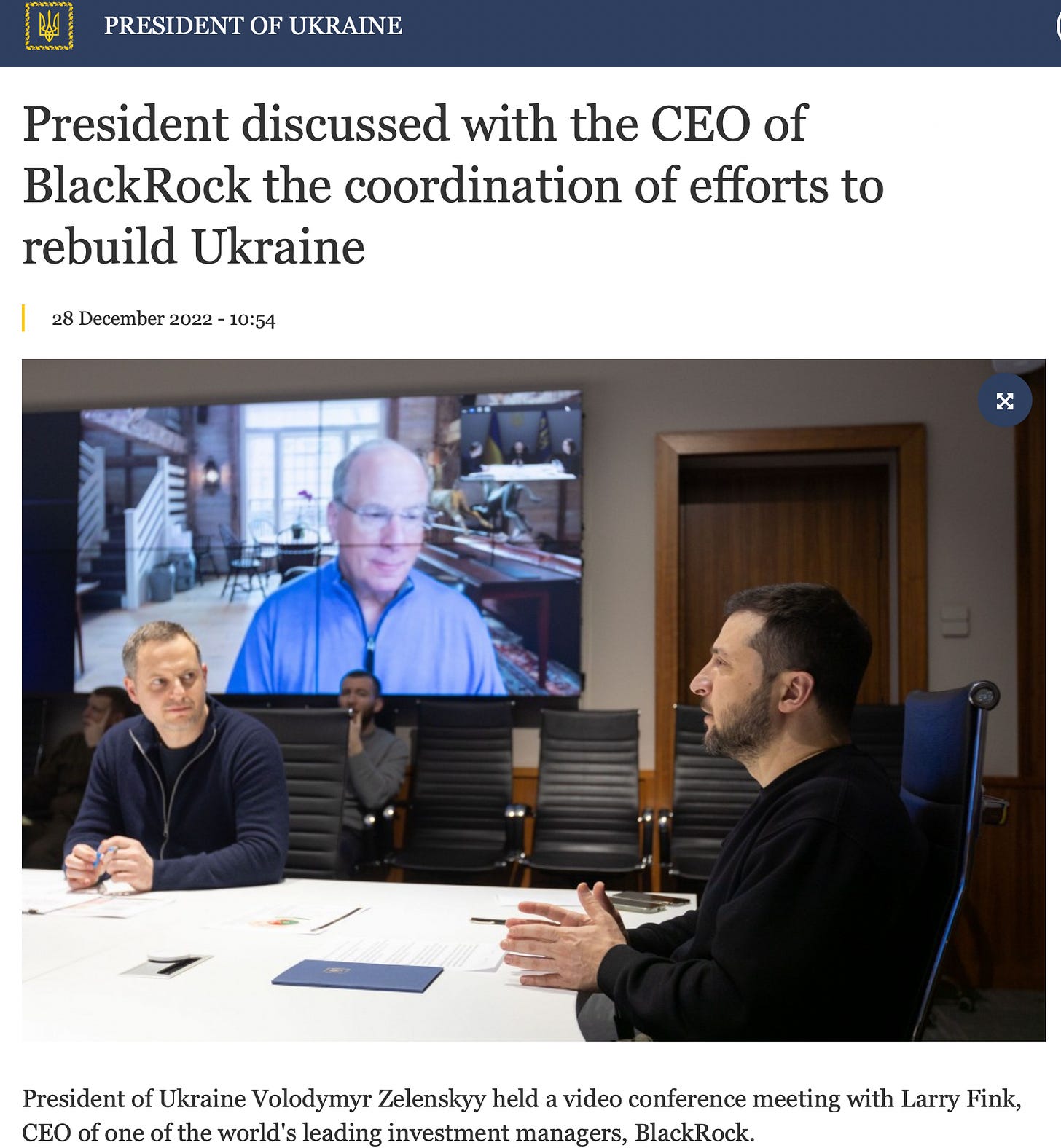

The Privatization of Ukraine

BlackRock, which is the World’s largest portfolio investment company together with JPMorgan have come to the rescue of Ukraine. They are slated to set up the Ukraine Reconstruction Bank.

The stated objective is “to attract billions of dollars in private investment to assist rebuilding projects in a war-torn country”. (FT, June 19, 2023)

“… BlackRock, JP Morgan and private investors, aim to profit from the country’s reconstruction along with 400 global companies, including Citi, Sanofi and Philips. … JP Morgan’s Stefan Weiler sees a “tremendous opportunity” for private investors. (Colin Todhunter, Global Research June 28, 2023)

The Kiev Neo-Nazi regime is a partner in this endeavour. War is Good for Business. The greater the destruction, the greater the stranglehold on Ukraine by “private investors”:

“BlackRock and JPMorgan Chase are helping the Ukrainian government set up a reconstruction bank to steer public seed capital into rebuilding projects that can attract hundreds of billions of dollars in private investment.” (FT, op cit)

The Privatization of Ukraine was launched in November 2022 in liaison with BlackRock’s consulting company McKinsey, a public relations firm which has largely been responsible for co-opting corrupt politicians and officials Worldwide not to mention scientists and intellectuals on behalf of powerful financial interests.

“The Kyiv government engaged BlackRock’s consulting arm in November to determine how best to attract that kind of capital, and then added JPMorgan in February. Ukraine president Volodymyr Zelenskyy announced last month that the country was working with the two financial groups and consultants at McKinsey.

BlackRock and Ukraine’s Ministry of Economy signed a Memorandum of Understanding in November 2023.

In late December 2022, president Zelensky and BlackRock’s CEO Larry Fink agreed on an investment strategy.

Ukraine Reconstruction: The London Conference Venue

Careful Timing (See Timeline Below). The Prigozhin-Wagner “Failed Coup” (June 23-24, 2023) was initiated on the day following the Ukraine Reconstruction Conference in London hosted by the Kiev Regime and His Majesty’s Government on June 21-22, 2023. Is it a coincidence?

“The Ukraine Development Fund remains in the planning stages and is not expected to fully launch until the end of hostilities with Russia. But investors will have a preview this week at a London conference co-hosted by the British and Ukrainian governments.

The World Bank estimated in March that Ukraine would need $411bn to rebuild after the war, and recent Russian attacks have driven that figure higher.

No formal fundraising target has been set but people familiar with the discussions say the fund is seeking to raise low-cost capital from governments, donors and international financial institutions and leverage it to attract between five and 10 times as much private investment.

BlackRock and JPMorgan are donating their services, although the work will give them an early look at possible investments in the country. The assignment also deepens JPMorgan’s relationship with a longstanding client.

What Ukraine needed, BlackRock advised, was a development finance bank to find investment opportunities in sectors such as infrastructure, climate and agriculture and make them attractive to pension funds and other long-term investors and lenders. JPMorgan was brought in partly for its debt expertise.

… most investors want to wait for the end of hostilities. “The important part is that Ukraine is already thinking ahead,” Weiler said. “When the war is over, they’re going to want to be ready and start the rebuilding process immediately.” (FT, 19 June, 2023, emphasis added)

King Charles V hosted a reception at St James’s Palace on the eve of the Ukraine Recovery Conference. See below.

Guests included the Prime Minister of Ukraine, Mr. Denys Shmyhal; President of European Commission, Dr. Ursula Von der Leyen and His Majesty’s Ambassador to Ukraine, Dame Melinda Simmons, who presented. Ukrainian civil society leaders. These leaders included Mr. Masi Nayyem [involved in the Neo-Nazi sponsored 2014 EuroMaidan], a decorated Ukrainian veteran and lawyer who received shrapnel wounds to the head on a combat mission during the invasion and now campaigns for veterans rights and support.

The Ukraine Privatization Chronology

November 2022. Contract with BlackRock and McKinsey, Ukraine Ministry of Economy

December 2022. Agreement between BlackRock CEO Larry Fink and President Zelensky

February 2023. JPMorgan Joins the BlackRock Reconstruction Bank Project

June 18, 2023. Africa Peace Initiative in Saint Petersburg, Statement by President Putin with regard the foiled peace negotiations of March 2022.

June 21-22, 2023. London conference pertaining to Ukraine Reconstruction Bank co-hosted by the British and Ukrainian governments.

June 23-24, 2023. The Prigozhin Wagner “Rebellion”

Concluding Remarks

All the major financial and political actors were in attendance at the Ukraine Reconstruction Conference in London.

Ukraine is in the stranglehold of Big Money. BlackRock and JPMorgan.

Destruction is the Driving Force behind “Reconstruction”.

Peace as well as “Cease Fires” are not “Good for Business”.

“Ukraine’s people desperately need a future based on welfare and peace, but in reality Ukraine is being driven towards the kind of huge indebtedness that leads to subservience and dominance.” (Bharat Dogra, Global Research, June 28, 2023)

The outcome is mass poverty and social devastation of an entire country, under the guise of “reconstruction”.

Update: January 2024

In recent developments, slated for early 2024: the State Property Fund of Ukraine plans to put up about 1,000 assets for privatization

The plan was outlined at the Six National Forum of SMB entitled

“Development of SMB 2023: opportunities, sustainability and recovery” (December 2023)

There are no opportunities: the mechanisms described suggest that these 1000 assets (or more) will be taken over. The small and medium sized businesses including agricultural and industrial SME will be wiped out. Many of these assets will be bought out at a negative price.

Vitaliy Koval, Chairman of the State Property Fund of Ukraine, presented the 2024 SPFU plan. He emphasized that small and medium-sized business will be main beneficiary of this process.

“We think that small and medium-sized business should be in the center of privatization process.

On December 13, 2023, the Six National Forum of SMB “Development of SMB 2023: opportunities, sustainability and recovery” was conducted under the auspices of the Ukraine Chamber of Commerce and Industry and the United Nations Development Programme in Ukraine. The Forum was held with the support of Switzerland and the Project “Strengthening of member business associations of micro, small and medium-sized enterprises in Ukraine”, implemented by UNDP in Ukraine.

According to Vitaliy Koval, in 2024 the Fund plans put up for privatization about a thousand objects that open up new opportunities for business. These assets will be auctioned, ensuring a fair and transparent process.

The transparent procedure coupled with rigged auctions are wrought with fraud and corruption. It’s akin to highway robbery:

He invited business to cooperate in searching for assets for privatization.

“We invite you to become Ambassadors in searching for assets for privatization.

Many cities, towns and villages have dormant assets during 10-15 years. We wait your proposals for privatization and do the best that the way to transparent auction will be the shortest,” said Vitaliy Koval. (State Property Fund of Ukraine emphasis added)